Pharmacy Benefits: What They Cover and How to Maximize Your Coverage

When you hear pharmacy benefits, the set of rules and coverage limits your health plan uses to decide which medications are covered and at what cost. Also known as prescription drug benefits, it’s not just about whether your pill is covered—it’s about how much you pay, where you fill it, and what steps you need to jump through to get it. Most people assume if a drug is FDA-approved, their insurance will pay for it. That’s not true. Pharmacy benefits are controlled by complex formularies, tiered pricing, and network restrictions that change every year.

These benefits aren’t random—they’re built around cost control and clinical guidelines. Your plan might cover Medicare Part D, the federal prescription drug program for seniors and people with disabilities but only if you pick a plan that includes your specific meds. Or maybe your employer’s plan uses a formulary, a list of approved drugs grouped by cost tiers that pushes you toward generics or cheaper alternatives. Some plans require prior authorization before they’ll pay for a brand-name drug. Others only cover medications from certain pharmacies in their network. Skip these rules, and you could pay double—or get denied entirely.

And it’s not just about the drug itself. Pharmacy benefits also affect how you take it. For example, if you’re on a long-term medication like insulin or a GLP-1 agonist, your benefit might limit how many pens you get per month. If you’re managing a chronic condition like high cholesterol, your plan might require you to try a generic statin first before covering a more expensive alternative like bempedoic acid. Even something as simple as switching pharmacies can trigger a coverage hiccup if your new pharmacy isn’t in-network.

These systems exist because drug prices are high, and insurers need to manage spending. But that doesn’t mean you’re powerless. Knowing how pharmacy benefits work lets you spot savings, challenge denials, and avoid surprise bills. You can compare plans during open enrollment, ask your pharmacist about tier alternatives, or request a formulary exception if your drug is excluded. The goal isn’t to fight the system—it’s to navigate it smarter.

Below, you’ll find real-world guides that break down exactly how pharmacy benefits play out in daily life. From how to switch Medicare drug plans without getting stuck with an expensive medication, to why your insurance might deny a generic you’ve been taking for years, these posts give you the tools to make informed choices. Whether you’re managing a chronic illness, helping an aging parent, or just trying to cut prescription costs, you’ll find practical steps you can use right away.

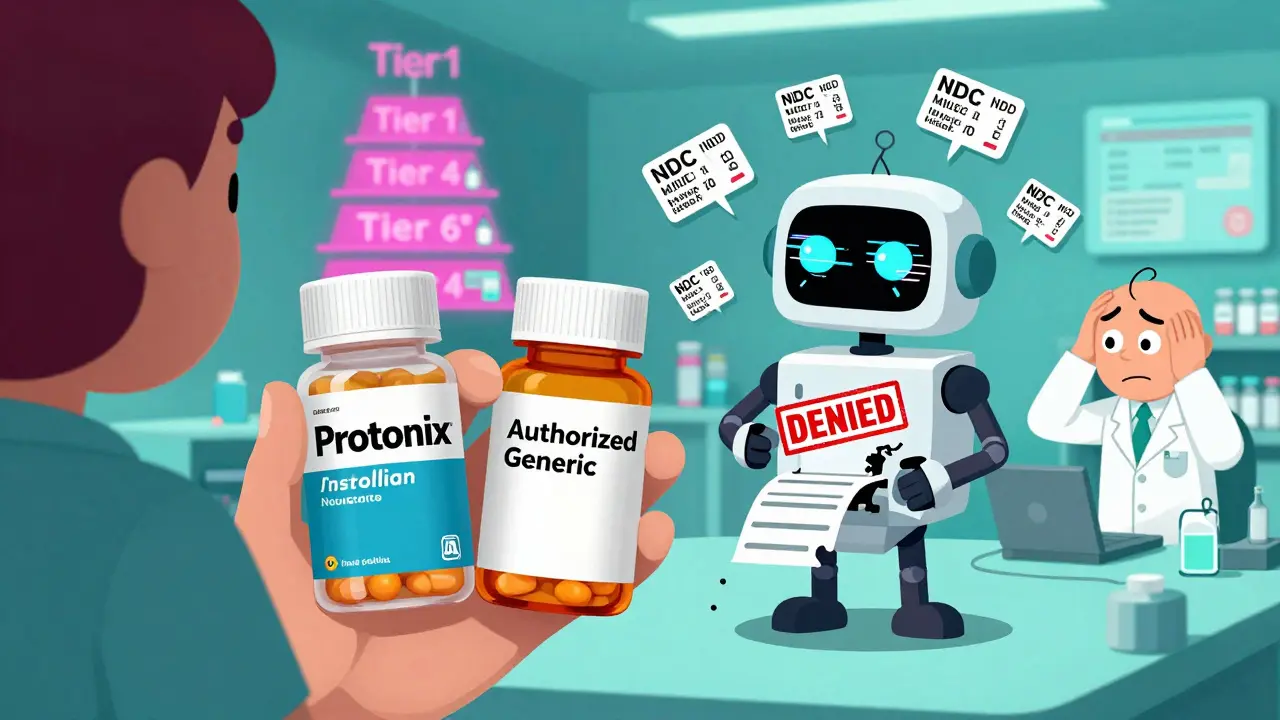

Insurance Coverage of Authorized Generics: How Formulary Placement Affects Costs and Access

Authorized generics offer brand-equivalent drugs at generic prices, but insurance coverage varies. Learn how formulary placement affects your costs, why some plans deny coverage, and what you can do to save money.

Insurance Coverage of Online Pharmacy Generics: What You Need to Know in 2025

Learn how insurance covers generic drugs from online pharmacies in 2025. Know the difference between mail-order and independent sites, how formularies work, and how to save money without getting burned.