When you fill a prescription for a medication like Protonix or Synthroid, you might not realize there are two types of generics floating around in the system: the kind made by a different company, and the authorized generic - the exact same pill, just without the brand name on the bottle. For insurers, this isn’t just a labeling quirk. It’s a cost-saving lever that can drop out-of-pocket expenses by 30% or more. But here’s the catch: not all insurance plans treat authorized generics the same way. Some cover them like regular generics. Others treat them like brand-name drugs. And some don’t even know they exist.

What Exactly Is an Authorized Generic?

An authorized generic isn’t a copy. It’s the real thing - made by the same company that produces the brand-name drug, under the same FDA-approved NDA. Think of it as the brand’s own generic version. The only differences? The packaging is simpler, the label doesn’t have the flashy brand name, and the price is lower. No bioequivalence studies are needed because it’s literally the same formula, same factory, same batch. The FDA defines it as a drug marketed under the original brand’s approval, just with different labeling.

Take Ocella, for example. It’s the authorized generic of Yasmin, made by Bayer. Same active ingredients, same inactive ones, same tablet shape. The only thing changed? The box says "Ocella" instead of "Yasmin." And the copay? Often $10 instead of $50. That’s not a discount. That’s the same drug at generic pricing.

Unlike traditional generics, which must go through an ANDA process and wait for exclusivity periods to expire, authorized generics can hit the market the day the brand patent ends - or even before. That gives manufacturers a way to keep market share while letting insurers pay less. But it also means traditional generic companies sometimes get squeezed out. A 2021 Health Affairs study found that in 22% of cases, an authorized generic delayed the entry of a true generic competitor.

Why Insurers Care About Formulary Placement

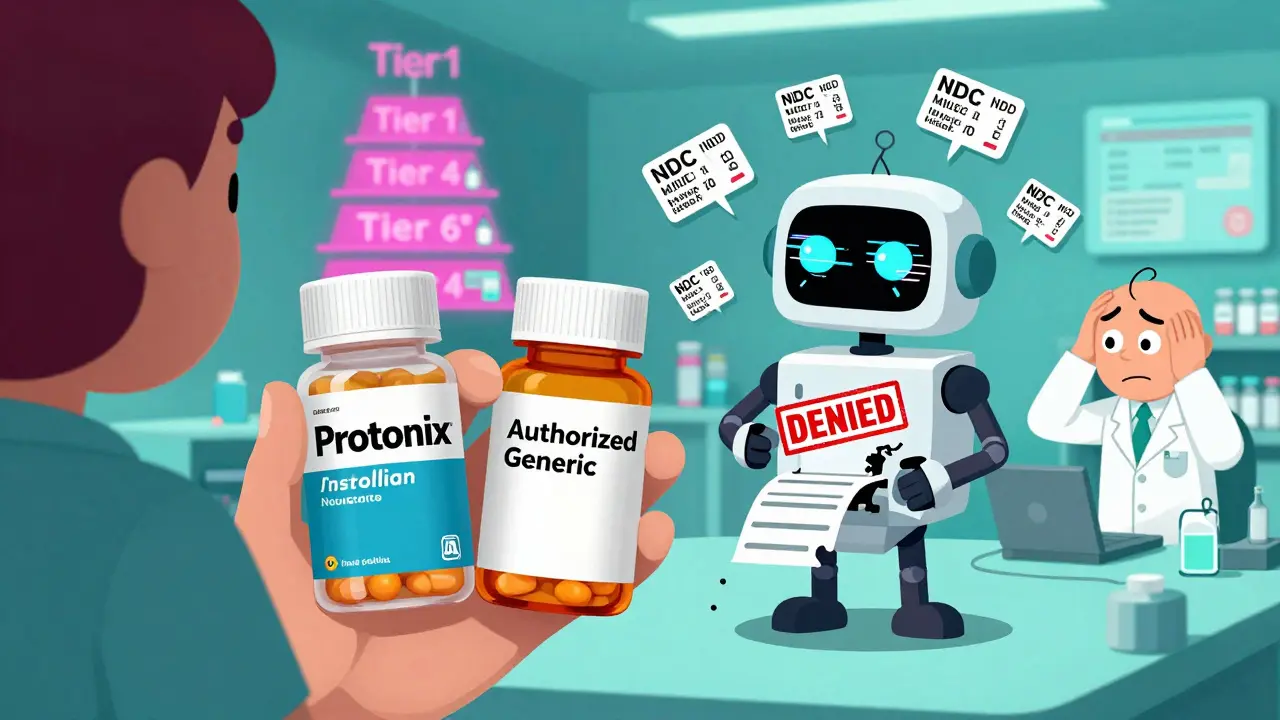

Insurance plans organize drugs into tiers. Tier 1 is usually the cheapest - often traditional generics. Tier 2 is higher-cost generics or preferred brands. Tier 3 and 4 are non-preferred brands and specialty drugs. Where a drug lands determines how much you pay at the pharmacy.

Authorized generics should logically sit in Tier 1 or Tier 2 - same as traditional generics. And most of the time, they do. A 2022 Health Affairs analysis of 1,247 Medicare Part D plans found that 87% placed authorized generics in the same tier as conventional generics. That’s good news. It means patients get brand-equivalent drugs at the lowest possible cost.

But 12% of plans still treat them like brand-name drugs. Why? Some PBMs haven’t updated their systems. Others are slow to recognize the NDC codes. And a few - quietly - want to keep patients on higher-cost brands to earn rebates. That’s where confusion kicks in. Patients get denied coverage. Pharmacists scratch their heads. Prescribers get calls asking why the generic isn’t covered.

Here’s what happens in real life: A patient on Synthroid gets switched to the authorized generic. Their insurance says "no coverage." Why? The system doesn’t recognize the NDC. The pharmacist has to call the PBM, explain it’s an authorized generic, and get it manually overridden. That’s not a system failure - it’s a policy gap.

Cost Savings Are Real - But Not Always Applied

Authorized generics cost 15-25% less than their brand-name equivalents. And they’re priced the same as traditional generics. That means insurers can save money without risking therapeutic outcomes. For drugs with narrow therapeutic windows - like warfarin, levothyroxine, or seizure meds - that’s huge. Switching to a traditional generic might mean a different filler or dye. For some patients, that causes side effects. Authorized generics eliminate that risk.

Plans that actively promote authorized generics see real savings. The same Health Affairs study showed that Medicare Part D plans with explicit authorized generic policies cut per-member-per-month prescription costs by 7.3%. That’s not a rounding error. That’s millions saved across a large plan.

And it’s not just Medicare. Commercial insurers are catching on. OptumRx rolled out an "Authorized Generic First" policy for 47 high-cost drugs in January 2023. Express Scripts added flags to their formulary system in late 2022. CVS Caremark updated their systems to recognize authorized generics within 30-45 days of launch. These aren’t small tweaks. They’re structural changes.

But adoption isn’t universal. Only about 15-20% of brand-name drugs have an authorized generic version. So for the rest, insurers still rely on traditional generics or brand-name drugs with rebates. That creates a patchwork. A patient on a brand drug with no authorized version might pay $75. The next patient on a similar drug with an authorized generic pays $12. That’s not fairness. That’s a system that rewards luck.

Challenges in Implementation

Here’s the dirty secret: pharmacies don’t always know they’re dispensing an authorized generic. The FDA doesn’t list them in the Orange Book, where most pharmacists check for generic equivalents. Instead, they have to cross-reference the FDA’s separate authorized generic list - a document most people don’t even know exists.

Walgreens reported a 12% error rate in processing authorized generic claims before they built a dedicated verification tool. That means one in eight claims got flagged wrong. Some were denied. Others were billed at brand prices. Patients got surprise bills. Prescribers got angry calls.

Even the coding is messy. Authorized generics have unique NDC codes - different from both the brand and the traditional generic. If the PBM’s database doesn’t map those codes correctly, the claim fails. That’s why tools like Prime Therapeutics’ AG Tracker matter. It covers 98% of available authorized generics. Without it, you’re flying blind.

And then there’s communication. A 2022 GoodRx survey found that 34% of patients didn’t know they’d been switched to an authorized generic. Eighteen percent got denied coverage because their insurance thought it was a brand drug. Patients felt misled. Pharmacists felt blamed. Everyone lost.

What Patients Should Do

If you’re on a brand-name drug and your copay is high, ask your pharmacist: "Is there an authorized generic?" Don’t assume the generic they give you is the same as the brand. Check the label. Look for the manufacturer’s name. If it’s the same company as the brand - like Pfizer, Bayer, or AbbVie - it’s probably an authorized generic.

Use GoodRx or SingleCare to compare prices. Sometimes the authorized generic costs less than the traditional generic. That’s rare, but it happens. And if your insurance denies coverage, call them. Ask specifically for the NDC code of the authorized generic. Most of the time, they’ll approve it - once they know what you’re asking for.

For patients with allergies or sensitivities to fillers, authorized generics are often the safest option. One Reddit user wrote: "My insurance denied Synthroid but approved the authorized generic with a $10 copay. I’ve been stable for 3 years now. No rashes, no crashes. Just the same pill, cheaper." That’s the story behind the data.

The Future: More Coverage, More Scrutiny

The Inflation Reduction Act of 2022 pushed CMS to prioritize lower-cost options in Medicare Part D. By 2025, they project a 15-20% increase in authorized generic coverage. Large employers are following suit. According to the Kaiser Family Foundation’s 2023 survey, 68% plan to differentiate coverage between authorized and traditional generics in 2024 - meaning they might cover the authorized version with a $0 copay and charge more for the traditional one.

But it’s not all smooth sailing. The FTC is watching. They’ve flagged authorized generics as potential anti-competitive tools. If a brand manufacturer uses an authorized generic to block true generic entry, that could trigger legal action. That’s why the FDA added new reporting rules under GDUFA III in 2023. Transparency is coming.

For now, the best move for patients and insurers is simple: know what you’re getting. Ask. Verify. Push back if you’re being charged brand prices for a generic drug. Authorized generics aren’t a loophole. They’re a smarter way to pay less for the same medicine. And if your plan doesn’t get that, it’s time to ask why.

Are authorized generics the same as brand-name drugs?

Yes. Authorized generics contain the exact same active and inactive ingredients as the brand-name drug. They’re made in the same factory, under the same FDA-approved NDA. The only differences are the packaging and labeling - no brand name, simpler design. They are therapeutically identical.

Why do insurance plans sometimes deny coverage for authorized generics?

Most often because the pharmacy benefit manager’s system doesn’t recognize the NDC code. Authorized generics aren’t listed in the FDA Orange Book, so many systems don’t auto-identify them. If the plan treats them as brand-name drugs by default, claims get denied. It’s a technical issue, not a clinical one. Calling the PBM and providing the correct NDC usually fixes it.

How do I know if my prescription is an authorized generic?

Check the label. If the manufacturer name matches the brand-name drug (e.g., Bayer for Yasmin), it’s likely an authorized generic. You can also ask your pharmacist directly or look up the drug on the FDA’s authorized generic list. Some apps like GoodRx will flag it too.

Are authorized generics cheaper than traditional generics?

Usually, they cost the same. But sometimes they’re cheaper - especially if the traditional generic has limited competition. In rare cases, the authorized generic may be the lowest-priced version available. Always compare prices using GoodRx or your insurer’s drug lookup tool.

Can I request an authorized generic from my doctor?

Yes. Ask your prescriber to write "Dispense as Written" or specify the authorized generic by name if it’s available. If your insurance requires prior authorization, your pharmacist can help submit the correct NDC code. You don’t need special permission - just clear communication.

I’ve been using the authorized generic for Synthroid for two years now and my thyroid levels are rock solid. My copay dropped from $48 to $12. No side effects, no drama. Just cheaper same-pill magic. Pharmacist even showed me the manufacturer label - it’s Pfizer, same as the brand. Why would anyone pay more?

Oh please. This whole ‘authorized generic’ thing is just Big Pharma’s way of keeping you hooked while pretending they’re helping. They make the exact same pill, slap on a new label, and then the PBMs still treat it like brand. It’s all a racket. They don’t want real generics because those don’t pay them kickbacks. You think this is about savings? Nah. It’s about control.

This is actually one of the most under-discussed wins in pharma policy. Authorized generics eliminate the variability risk that comes with switching to traditional generics - especially for drugs like levothyroxine where tiny differences in fillers can throw off your labs. I’ve worked in pharmacy for 12 years and I’ve seen patients crash after switching to a generic with a different dye. Authorized generics? Zero issues. Just cheaper. The fact that some insurers still don’t get it is insane.

So let me get this straight… the brand makes the ‘generic’ version… of itself… and now we’re supposed to be impressed? That’s like McDonald’s selling ‘McDonald’s Cheeseburger (No Logo Edition)’ for $1 cheaper. The system is BROKEN. And don’t even get me started on how PBMs still mess up the NDC codes. My last claim got denied because the system thought ‘Ocella’ was a brand drug. I had to call three times. And the pharmacist looked at me like I was speaking Klingon.

I just want to say how much this matters for people with autoimmune conditions or severe allergies. I have a history of reactions to dyes and fillers - not the active ingredient, but the crap they put in the pill. When I switched from brand Synthroid to the authorized generic, I didn’t just save money - I stopped getting rashes and brain fog. The FDA says it’s the same, and I believe them because my body knows. But I had to fight my insurer for weeks. They kept saying ‘generic’ meant ‘not the same’. It’s not just a cost issue - it’s a safety issue too. If your plan doesn’t cover it, ask. Push. Send them the FDA’s authorized generic list. It’s not that hard. And if they say no? Tell them you’ll switch plans next open enrollment. They hate that.

THIS IS A TRAP. Authorized generics are the new opioid playbook. Pharma companies create them to kill competition, then they get reimbursed as brand drugs through backdoor rebates. The FTC is already investigating. You think your $10 copay is a win? It’s a trap. The real cost is hidden in your premiums. And your pharmacist? They’re not helping you - they’re just following the system that’s rigged to enrich insurers and manufacturers. Wake up. This isn’t savings. It’s psychological manipulation dressed up as healthcare.

In India, generics are everywhere and they’re cheap because we don’t have these corporate games. We have 50 companies making the same levothyroxine, and the price is 90% lower than the US. Here, you have one company making the brand, then making the ‘authorized generic’ - which is still the same thing - and calling it innovation. This isn’t healthcare. It’s capitalism with a medical mask. Why does it take 30 days for CVS to update their system? Because they don’t care. They’re not here to help you. They’re here to profit. Your life is a spreadsheet.

Authorized generics are not generics. They are branded drugs with different packaging. The FDA does not classify them as generics. Insurers are correct to treat them as brand-name unless explicitly coded otherwise. Mislabeling them as ‘generic’ is misleading and undermines the integrity of the formulary system. Patients should be informed - not manipulated into thinking they’re getting a cheaper alternative when they’re not.

Let’s be real - this entire article reads like a corporate press release written by a PBM intern. ‘Authorized generics’ are a PR stunt. The real story? The FDA doesn’t even list them in the Orange Book. That’s not an oversight - it’s a cover-up. Why? Because if patients knew how many ‘generics’ are just rebranded brands, they’d riot. And don’t get me started on how some plans now charge MORE for traditional generics than authorized ones. That’s not innovation. That’s extortion.

In my culture, we don’t see medicine as a product to be branded. We see it as a shared human need. The fact that we’re debating whether a pill with the same chemistry but a different label deserves a lower copay reveals how far we’ve drifted from medicine as care. The system isn’t broken - it was designed this way. Profit before person. Marketing over medicine. This isn’t about generics. It’s about whether we still believe healing should be accessible - or just affordable for those who know the right codes.

Just asked my pharmacist if my Protonix was an authorized generic. He said yes, same maker as brand. Copay was $8. I almost cried. My last script was $47. I didn’t even know this was a thing. Thank you for writing this. I’m telling everyone I know. Also - if your insurance denies it, just say ‘I need the NDC for the authorized generic’ and send them the FDA list. It works. I did it twice.

Why is no one talking about how authorized generics are used to suppress competition? The 2021 Health Affairs study showed they delay true generics in 22% of cases. That’s not innovation - that’s market manipulation. And now insurers are rewarding them with tier 1 status? You’re not saving money - you’re enabling monopolistic behavior. This isn’t healthcare reform. It’s corporate consolidation with a smiley face.

As someone who works with immigrant communities, I see this daily. People get confused because their insurance says ‘generic not covered’ - but the pill in their hand is literally the same as the brand. They panic. They stop taking it. I’ve had to explain this to 15 people this month alone. The problem isn’t the science. It’s the communication. We need better labeling. We need pharmacy staff trained. We need simple infographics. This isn’t rocket science - it’s basic patient education. And nobody’s doing it.

From a pharmacoeconomic standpoint, authorized generics represent a unique convergence of regulatory efficiency and market dynamics. They circumvent the ANDA pathway while preserving therapeutic equivalence, thereby reducing transactional friction in formulary management. However, the absence of standardized NDC mapping across PBMs creates systemic inefficiencies that manifest as adverse patient outcomes - particularly in populations with limited health literacy. The structural failure lies not in the drug classification, but in the archaic IT infrastructure of third-party administrators who still rely on legacy formulary engines built for the pre-2010 era. Until we modernize the claims adjudication layer, we’re just rearranging deck chairs on the Titanic.

Okay but what if you don’t even want an authorized generic? What if you like the brand? Or you’re used to the shape? Or you just don’t trust anything that doesn’t have the original logo? I got switched without being told. I found out because my pill looked different. I called my doctor and she said ‘oh yeah, that’s the authorized one now’ - like it was nothing. But I had a panic attack. I thought they gave me the wrong drug. No one asked me. No one told me. I just got a different pill and now I’m paying less - but I feel like I lost control. Is that really progress?