When you buy generic medications from an online pharmacy, your insurance might cover it - or it might not. It depends on which pharmacy you use, what your plan allows, and whether the drug is on your formulary. Too many people assume that if a pharmacy is online, it works like your local CVS or Walgreens. That’s not true. And the difference can cost you hundreds a year.

Not All Online Pharmacies Are the Same

There are two kinds of online pharmacies that matter for insurance: mail-order pharmacies tied to your plan and independent online pharmacies. They operate completely differently.Mail-order pharmacies like Express Scripts, CVS Caremark, and Optum Rx are part of your insurance plan’s pharmacy benefit manager (PBM) network. These are the ones your insurer pushes you toward for maintenance meds like blood pressure pills, diabetes drugs, or thyroid medication. You get a 90-day supply, usually shipped to your door in about a week. Your copay? Often $5 for a 30-day supply or $10 for 90 days - way cheaper than retail.

Independent online pharmacies? Those are sites like Amazon Pharmacy, Honeybee Health, or random drug sellers you find on Google. They’re not part of your PBM. Some accept insurance. Most don’t. Even if they say they do, they might only accept certain plans - and you’ll have to submit claims manually. If you pay out of pocket and try to get reimbursed, you’re playing a game with paperwork, deadlines, and no guarantee you’ll get your money back.

Amazon Pharmacy’s RxPass is a good example. For $5 a month, Prime members get access to over 100 common generics - no copay, no deductible. But it’s not insurance. It’s a subscription. And if your medication isn’t on the list (like a specific thyroid drug or a rare antibiotic), you’re back to square one.

Your Insurance Formulary Is the Real Gatekeeper

Your plan doesn’t cover every generic. It only covers the ones on its formulary - a secret list that changes every year. And it’s not just about whether the drug is generic. It’s about which generic.For example, your doctor prescribes lisinopril 10mg. Your formulary might cover three different generic versions - but only one has a $5 copay. The other two? $15 or $20. Why? Because your PBM has a deal with one manufacturer. You don’t get a say. The pharmacist doesn’t either. The system auto-selects the cheapest option.

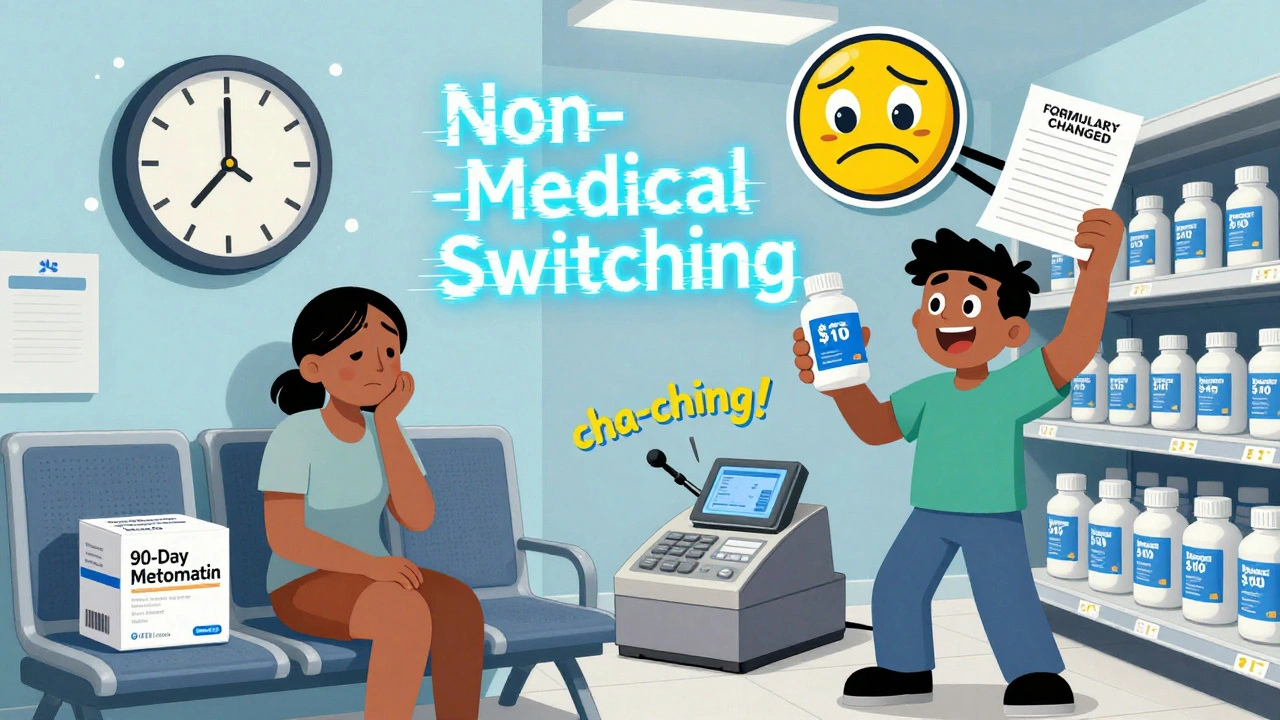

That’s called non-medical switching. It’s legal. And it’s common. Insurers force you onto cheaper generics - even if your doctor says your current brand works better. A 2023 survey found 27% of insurance-related pharmacy calls were from people confused about why their meds were switched without warning. One patient with multiple sclerosis reported severe side effects after her insurer switched her from Copaxone to a generic without telling her. She ended up in the ER.

Doctors know your body. Insurers know their bottom line. That tension is built into the system.

Mail-Order vs. Retail: The Real Cost Breakdown

Let’s say you take metformin for diabetes. Here’s what you might pay in 2025:- Mail-order (through your plan): $10 for a 90-day supply (that’s $3.33 per month)

- Retail pharmacy (CVS, Walgreens): $15 for 30 days (that’s $5 per month)

- Walmart’s $4 generic program: $10 for 90 days (no insurance needed)

- Amazon RxPass: $5/month flat fee (covers metformin)

See the pattern? Insurance doesn’t always win. If you have a high-deductible plan, you might pay more out-of-pocket at a retail pharmacy than if you just paid cash at Walmart. That’s why millions of Americans skip insurance entirely for generics - and use GoodRx or SingleCare coupons instead.

Mail-order is great for stable, long-term meds. But if you need antibiotics after surgery or a new prescription for an infection, waiting a week isn’t an option. Retail pharmacies win here. And if your plan doesn’t cover urgent meds at mail-order, you’re stuck paying full price.

How to Check Coverage Before You Order

Never assume. Always check. Here’s how:- Find your plan’s formulary. Log into your insurer’s member portal. Search for your drug by name. Look for the tier - Tier 1 is usually cheapest.

- Check if mail-order is available. Look for a “Mail Order Pharmacy” section. If it’s there, you can order 90-day refills online.

- Call your pharmacy. If you’re using an independent online pharmacy, call them. Ask: “Do you accept my insurance plan? What’s my copay?” Write down the name of the person you speak to.

- Use your PBM’s tool. CVS Caremark, Express Scripts, and Optum Rx all have online cost-checkers. Enter your drug and zip code. It’ll show you prices at network pharmacies.

Pro tip: If your drug isn’t on the formulary, your doctor can file a formulary exception request. You’ll need a letter explaining why the generic isn’t working for you. It’s not guaranteed, but it’s your right.

What Happens If You Use an Out-of-Network Pharmacy?

Big mistake. If you order from a pharmacy that’s not in your plan’s network, your insurance won’t pay a cent. Not even a partial amount. You pay full price. Then you can try to file a claim for reimbursement - but most plans won’t reimburse for out-of-network pharmacy purchases unless it’s an emergency.One 2023 case study: A woman in Florida ordered her cholesterol med from a website she found on Google. She paid $80. Her insurance denied her claim because the pharmacy wasn’t in-network. She lost $80. And she had to restart the process with a local pharmacy.

Always verify: Is this pharmacy listed on your insurer’s website? If not, don’t risk it.

The New Players: Subscription Models Are Changing the Game

Amazon RxPass, Honeybee Health, and other direct-to-consumer services are forcing PBMs to respond. These models don’t use insurance. They cut out the middleman. You pay a flat monthly fee - and get your meds delivered.Why does this matter? Because it’s cheaper than copays for people with high-deductible plans. And it’s simpler. No forms. No prior authorizations. No surprise bills.

But here’s the catch: these services only cover about 1.2% of all generic prescriptions. They don’t have every drug. And they’re only available to people who already pay for Amazon Prime or similar subscriptions.

Still, it’s a sign of things to come. In 2025, 45% of maintenance generics will be delivered by mail or home delivery - up from 32% in 2022. That shift is being driven by insurers, employers, and now, tech companies.

What You Can Do Right Now

Don’t wait for your next refill to figure this out. Take five minutes today:- Check your plan’s formulary online.

- Compare the price of your generic at your local pharmacy vs. mail-order vs. Walmart’s $10 list.

- Call your insurer’s pharmacy help line (most have a 24/7 nurse line - like MHBP’s 1-800-556-1555).

- If you’re on a high-deductible plan, ask if cash prices are lower than your copay.

You’re not powerless here. You just need to know how the system works. And once you do, you can save hundreds - or even thousands - a year.

Do all online pharmacies accept insurance?

No. Only mail-order pharmacies tied to your insurance plan’s pharmacy benefit manager (PBM) - like Express Scripts or CVS Caremark - automatically accept your insurance. Independent online pharmacies like Amazon Pharmacy or random sites you find online may or may not accept your plan. Always call them first and ask.

Why did my insurance switch my brand drug to a generic without telling me?

This is called non-medical switching. Insurers do it to save money, not because your doctor recommends it. They change your formulary, and if your brand-name drug is no longer preferred, they automatically switch you to a cheaper generic. You might not get notified. If it causes side effects, ask your doctor to file a formulary exception.

Is Amazon Pharmacy cheaper than my insurance?

For some people, yes. If you’re on a high-deductible plan and your copay for a generic is $15, Amazon RxPass at $5/month might be cheaper - if your drug is on their list. But if you need a medication that’s not included, you’ll pay full price. It’s not a replacement for insurance - it’s an alternative for common generics.

Can I use GoodRx with my insurance?

You can’t use GoodRx and your insurance at the same time. But you can compare the GoodRx price to your insurance copay and choose the lower one. Many people find GoodRx prices are cheaper than their insurance copay, especially with high-deductible plans.

What if I need a medication right away?

Mail-order pharmacies take about a week to deliver. If you need a drug immediately - like antibiotics or pain meds after surgery - go to a local pharmacy. Mail-order is only for maintenance drugs you take every day, not urgent prescriptions.

Are generic drugs as effective as brand-name drugs?

Yes. The FDA requires generic drugs to have the same active ingredients, strength, dosage form, and route of administration as the brand-name version. They must work the same way in your body. The only differences are in inactive ingredients - like fillers or dyes - which rarely affect how the drug works.

Just a heads-up - if you're on a high-deductible plan, always check GoodRx before even looking at your insurance copay. I saved $42 last month on my metformin by just using the Walmart $10 90-day deal. No hassle, no forms. The system’s broken, but you don’t have to play by its rules.

Ah yes, the neoliberal pharmacy-industrial complex - where commodification of biological necessity is masked as ‘consumer choice.’ The PBM oligarchs have engineered a labyrinthine formulary architecture to extract surplus value from chronically ill populations, while peddling ‘convenience’ via Amazon RxPass as a neoliberal panacea. It’s not about access - it’s about disciplining the body into cost-efficiency metrics. The FDA’s bioequivalence standards? A rhetorical fig leaf. The inactive ingredients? They’re not inert - they’re ideological.

Wow. Someone actually read all that. Congrats. You win the prize for most time wasted on insurance bureaucracy this week.

You’re all missing the point. The real scam isn’t the PBMs - it’s the FDA allowing generics to be ‘bioequivalent’ at all. 27% of patients have adverse reactions to generic switches? That’s not ‘non-medical switching’ - that’s medical malpractice by proxy. And don’t get me started on Amazon RxPass - it’s a Trojan horse for corporate monopolization. If you’re not paying full price at a licensed pharmacy, you’re just gambling with your life. And yes, I’ve seen people die because they trusted a coupon.

I can’t believe this is even a conversation. My wife got switched from her thyroid med last year - no warning - and she ended up in the hospital with heart palpitations. They didn’t even call to say sorry. Just sent a new prescription. I called the insurance company and they said, ‘It’s on the formulary, sir.’ Like that’s an excuse. I’ve been screaming into the void for months. Nobody listens. Nobody cares. It’s just money. Always money.

It is statistically and ethically indefensible that pharmaceutical benefit managers, entities with zero clinical training and no fiduciary duty to patients, are permitted to dictate therapeutic outcomes based solely on rebate structures negotiated with manufacturers. The absence of transparency in formulary tiering constitutes a violation of the principle of informed consent. Furthermore, the proliferation of direct-to-consumer subscription models like Amazon RxPass introduces an asymmetrical market distortion wherein socioeconomic status becomes the primary determinant of therapeutic access - a regression to pre-ACA healthcare paradigms under the guise of innovation. This is not progress. It is predatory extraction.

Look, I get it - the system’s rigged. But here’s what works: if you’re on a high-deductible plan, forget insurance for generics. Use GoodRx. Go to Walmart. Use SingleCare. I’m from India, and I’ve seen how absurdly expensive this stuff is here - so when I came to the US and found $10 for 90 days of metformin? I cried. Not because it’s fair - because it’s possible. You’re not powerless. You just need to hack the system. And yes, call your insurer. Ask for the formulary exception. They hate it when you do that. Do it anyway.

Let me get this straight - you’re telling people to use Amazon and Walmart instead of their insurance? That’s not freedom, that’s surrender. This is America. We don’t outsource our healthcare to tech bros and discount retailers. If you’re on Medicare or a private plan, you paid for this coverage. Use it. Support the system. Otherwise, you’re just enabling the collapse of American healthcare. And don’t even get me started on foreign generics - those aren’t even FDA-approved. You’re playing Russian roulette with your life.