Insurance Coverage: What You Need to Know About Medication and Health Plan Limits

When you hear insurance coverage, the extent to which a health plan pays for medical services, including prescription drugs. Also known as pharmaceutical benefits, it’s not just about whether your pill is covered—it’s about how much you pay out of pocket, which pharmacy you can use, and whether your plan changes next year without warning. Many people assume if a drug is on their formulary, they’re safe. But insurance coverage can shift overnight: a drug moves from tier 2 to tier 3, your pharmacy gets dropped from the network, or your deductible resets. That $50 co-pay can jump to $300 in a single month.

Medicare Part D plans are a perfect example. They’re offered by private insurers but regulated by the government, and each one has its own list of covered drugs, called a formulary. During Medicare open enrollment, the annual period when beneficiaries can switch drug plans to better match their needs, you’re not just comparing prices—you’re checking if your specific medication is still covered, whether a prior authorization is required, and if your usual pharmacy is still in-network. Missing this window can lock you into higher costs for a full year. And it’s not just seniors: employer plans, Medicaid, and private insurers all have their own rules. Some require step therapy—trying cheaper drugs first—or limit quantities. Others exclude certain brands entirely, even if your doctor swears by them.

Then there’s the hidden layer: prescription drug costs, the total amount you pay after insurance applies its rules, including copays, coinsurance, and deductibles. A drug might be "covered," but if your plan has a high deductible or 40% coinsurance, you’re still paying hundreds. And with newer drugs like GLP-1 agonists or tirzepatide, coverage is inconsistent—some plans cover them for diabetes but not weight loss, even though the same pill is used. You might need a letter from your doctor, proof of failed alternatives, or even a special appeal. It’s not just paperwork; it’s a system designed to control spending, not always to make sense for patients.

What you’ll find in the posts below isn’t theory—it’s real-world navigation. How to check if your drug is still covered before Open Enrollment. Why some generic drugs take years to appear after patent expiration. How insurance rules affect cancer chemo, fertility meds, and even over-the-counter pain relievers. You’ll see how patients are getting hit with surprise bills for drugs they thought were covered, and what they did to fix it. This isn’t about reading fine print—it’s about knowing what to ask, when to push back, and how to protect yourself before you’re stuck with a $1,000 bill for a pill your doctor prescribed.

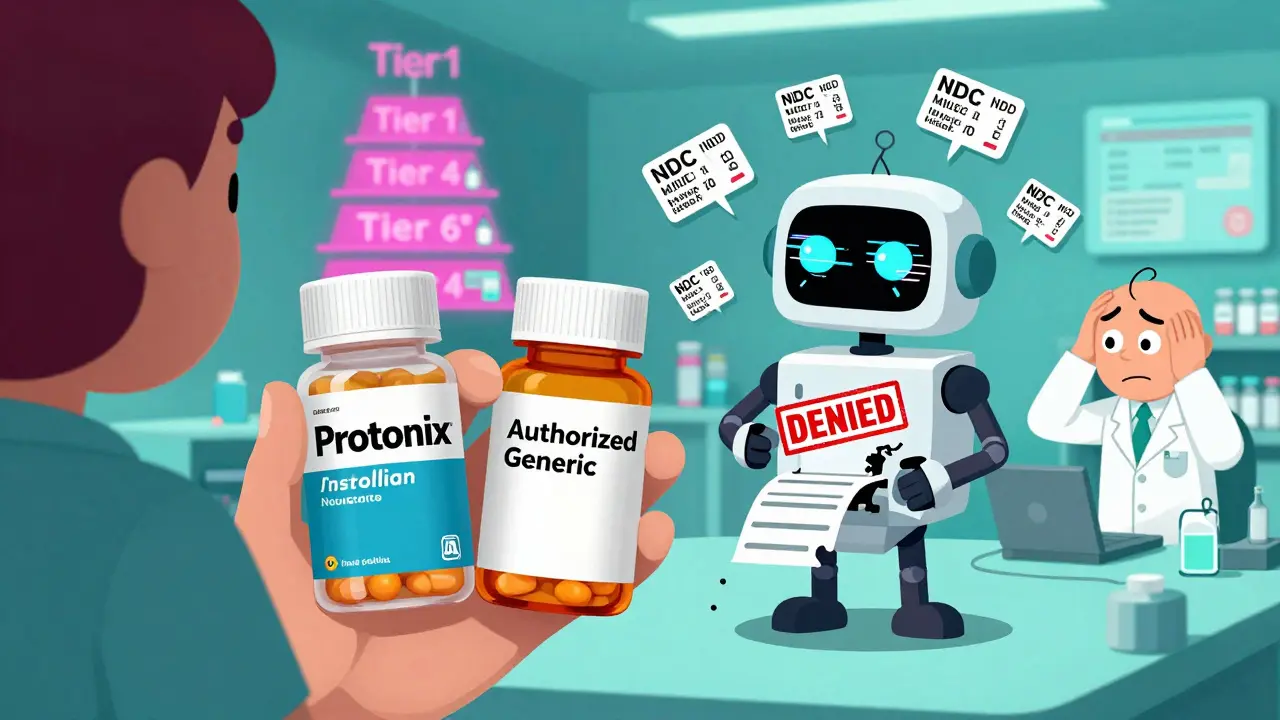

Insurance Coverage of Authorized Generics: How Formulary Placement Affects Costs and Access

Authorized generics offer brand-equivalent drugs at generic prices, but insurance coverage varies. Learn how formulary placement affects your costs, why some plans deny coverage, and what you can do to save money.

Insurance Coverage of Online Pharmacy Generics: What You Need to Know in 2025

Learn how insurance covers generic drugs from online pharmacies in 2025. Know the difference between mail-order and independent sites, how formularies work, and how to save money without getting burned.