Prescription Drug Costs: What You Really Pay and How to Save

When you pick up a prescription, the price tag often feels random—sometimes it’s $5, sometimes it’s $500. That’s because prescription drug costs, the amount you pay out of pocket for medications prescribed by a doctor. Also known as out-of-pocket drug expenses, they’re shaped by patents, insurance rules, and where you buy the drug—not just the pill inside the bottle. You might think all brand-name drugs are expensive, but the real issue isn’t just the brand. It’s the system behind them: how long generics wait to launch, how insurance formularies block access, and why the same drug costs twice as much at one pharmacy versus another.

Generic drugs, medications that are chemically identical to brand-name versions but sold after patents expire. Also known as off-patent drugs, they’re the biggest tool for lowering prescription drug costs. But they don’t always show up right away. Legal delays, patent thickets, and manufacturer tactics can hold them back for years. Meanwhile, insurance coverage, how your health plan pays for or limits access to medications. Also known as pharmacy benefits, it’s not a guarantee—it’s a maze. Some plans cover generics but not the brand. Others require prior authorization. Some only pay if you use mail-order. And if you’re on a high-deductible plan, you might pay full price until you hit that deductible—no matter how cheap the drug is in theory.

It’s not just about what’s on the label. It’s about where you live, what pharmacy you use, and whether you know to ask for a cash price instead of using insurance. A 30-day supply of a common generic might cost $4 at Walmart but $40 at your local pharmacy—if your insurance doesn’t cover it. And that’s before you factor in the hidden costs: copay tiers, step therapy, and formulary changes that happen without warning. People with chronic conditions, like diabetes or high cholesterol, face the worst of it. One study found that 1 in 4 Americans skip doses because of cost. That’s not just inconvenient—it’s dangerous.

Below, you’ll find real-world breakdowns of how drug pricing works, what insurers hide in fine print, and which strategies actually cut your bills. From Indian generic manufacturers supplying half the world’s meds to how bioequivalence studies ensure generics work the same, we cover what matters—no fluff, no jargon, just what you need to pay less and stay healthy.

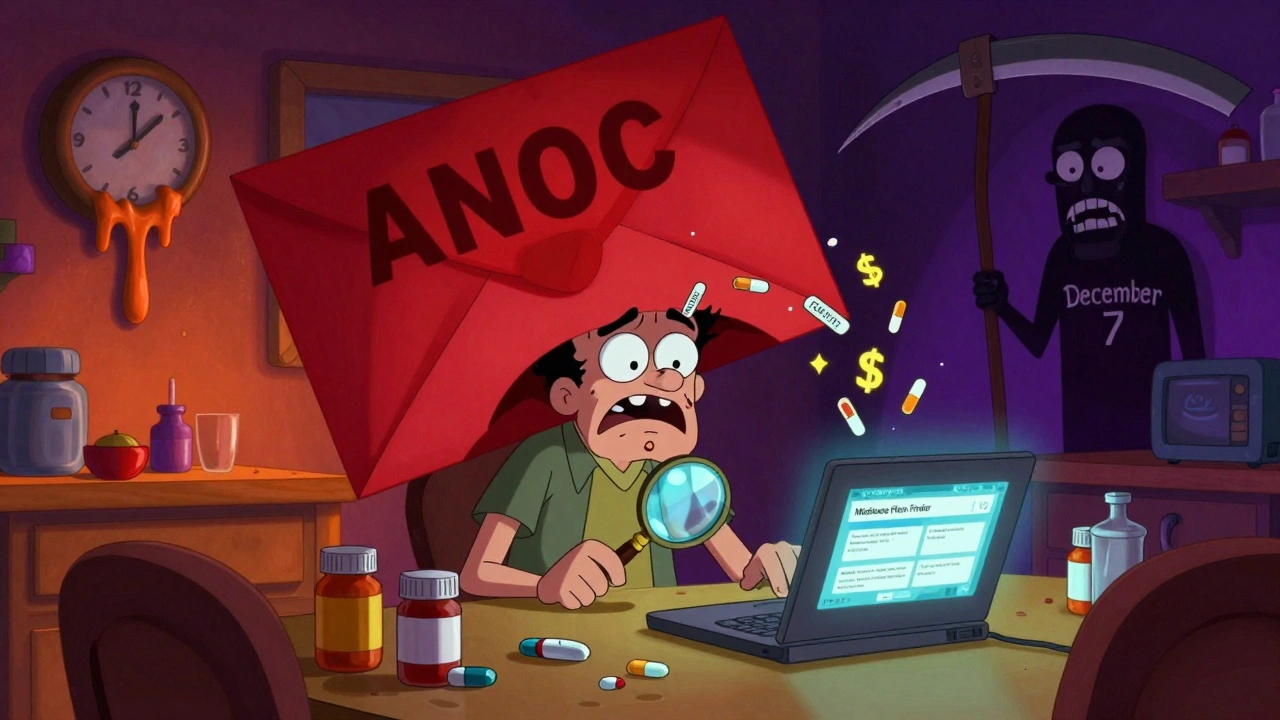

How to Plan Annual Open Enrollment for Medication Coverage in Medicare

Learn how to review and switch Medicare drug plans during Open Enrollment to save hundreds on prescriptions. Avoid costly formulary changes and pharmacy network pitfalls with this step-by-step guide.