Part D Plans: What You Need to Know About Medicare Prescription Drug Coverage

When you’re on Medicare, Part D plans, standalone prescription drug coverage offered by private insurers approved by Medicare. Also known as Medicare drug plans, they help pay for medications you take at home—things like insulin, blood pressure pills, or cholesterol drugs—that Original Medicare doesn’t cover on its own. Almost every Medicare beneficiary needs one, because without it, you could end up paying full price for drugs that cost hundreds a month.

Part D plans aren’t all the same. Each one has its own formulary, a list of drugs the plan covers, organized into tiers with different costs, and your out-of-pocket costs change depending on which drugs you take. Some plans have low monthly premiums but high copays for popular meds. Others charge more upfront but cover more generics. The donut hole, a coverage gap where you pay more out of pocket after spending a certain amount on drugs used to be a big problem—but now, discounts and manufacturer rebates cut those costs way down. And if your income is low, you might qualify for Extra Help, a federal program that slashes your Part D expenses even further.

Choosing the right plan isn’t just about price. It’s about matching your meds to the plan’s formulary. If you take Ozempic, for example, not every Part D plan covers it, or they might require you to try cheaper drugs first. Same goes for newer weight-loss meds like Zepbound or diabetes drugs like tirzepatide. You also need to check if your pharmacy is in-network. Mail-order pharmacies often offer better prices, but if you rely on your local drugstore, make sure it’s covered. And don’t forget: if you skip signing up when you’re first eligible, you could pay a late enrollment penalty forever—unless you have other creditable coverage.

Below, you’ll find real-world guides on how insurance covers generic drugs, how to spot coverage gaps, and what to do when your meds aren’t listed. You’ll learn how formularies work, why some plans delay generic launches, and how to avoid paying more than you have to. Whether you’re helping a parent navigate their first Part D enrollment or managing your own meds after 65, these posts cut through the noise and give you what actually matters.

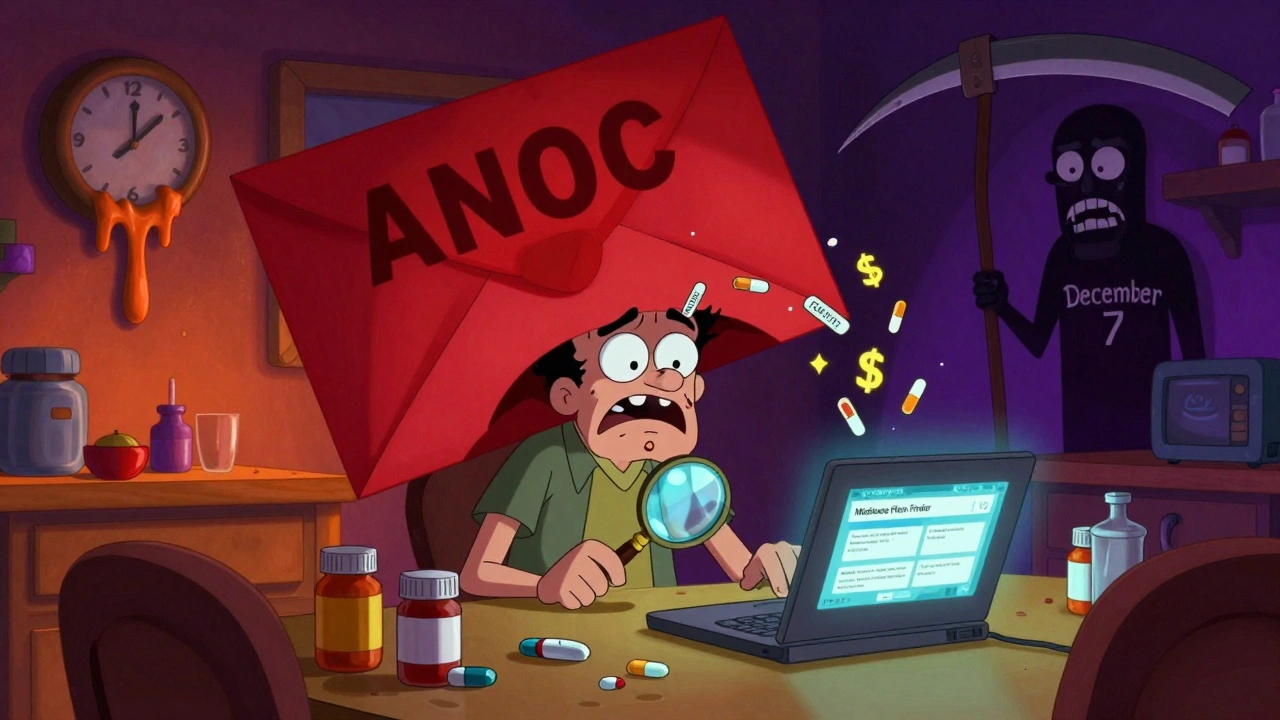

How to Plan Annual Open Enrollment for Medication Coverage in Medicare

Learn how to review and switch Medicare drug plans during Open Enrollment to save hundreds on prescriptions. Avoid costly formulary changes and pharmacy network pitfalls with this step-by-step guide.