Medication Coverage: What Your Insurance Really Pays For

When you pick up a prescription, medication coverage, the part of your health plan that pays for drugs. Also known as pharmacy benefits, it’s not just about whether your drug is covered—it’s about how much you pay, which version you get, and why some pills cost less than others. Most people assume if a drug is on their plan, they’re golden. But that’s not always true. Insurance companies use lists called formularies, curated lists of approved drugs grouped by tiers to control costs. Tier 1? Usually generics, maybe $5. Tier 3 or 4? Brand names or specialty meds, could be $100 or more. And if your drug isn’t on the list? You’re stuck paying full price unless you appeal.

That’s where generic drugs, medications with the same active ingredients as brand names but at lower prices come in. They’re not cheaper because they’re weaker—they’re cheaper because they don’t carry the marketing and R&D costs of the original. But here’s the catch: not all generics are treated equally by insurers. Some plans push mail-order pharmacies for 90-day supplies to save money. Others only cover certain manufacturers. And if your doctor prescribes a brand you can’t afford, you might need prior authorization, step therapy, or even a letter from your doctor just to get the drug you need. The system isn’t broken—it’s designed to make you jump through hoops before you get what’s right for you.

And it’s not just about price. insurance coverage, the actual amount your plan pays toward your meds changes depending on your plan type, deductible, and even the pharmacy you use. A drug covered at 80% at CVS might be 100% covered at a mail-order pharmacy, but you have to wait weeks for delivery. Some plans won’t cover certain drugs unless you’ve tried cheaper ones first—like forcing you to try an old generic before letting you use a newer, better one. Meanwhile, newer treatments like GLP-1 agonists or tirzepatide might be covered at all… or not at all, depending on your plan’s rules. It’s confusing, but you’re not alone. Millions of people are trying to figure out the same thing: why does this cost so much, and why won’t my insurance just pay?

Below, you’ll find real, practical breakdowns of how medication coverage works in 2025—from how online pharmacies fit into the picture, to why some drugs take years to become generic, to how insurers decide what’s worth covering. No fluff. No jargon. Just what you need to know to get your meds without overpaying.

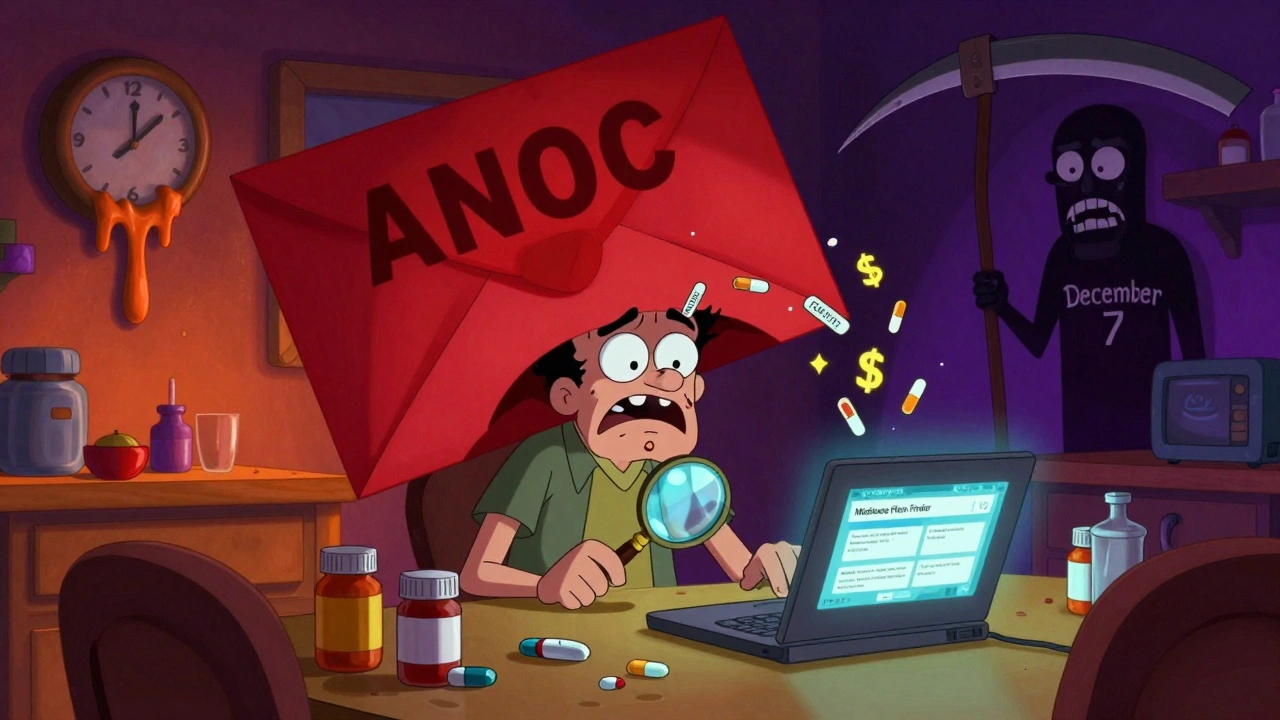

How to Plan Annual Open Enrollment for Medication Coverage in Medicare

Learn how to review and switch Medicare drug plans during Open Enrollment to save hundreds on prescriptions. Avoid costly formulary changes and pharmacy network pitfalls with this step-by-step guide.