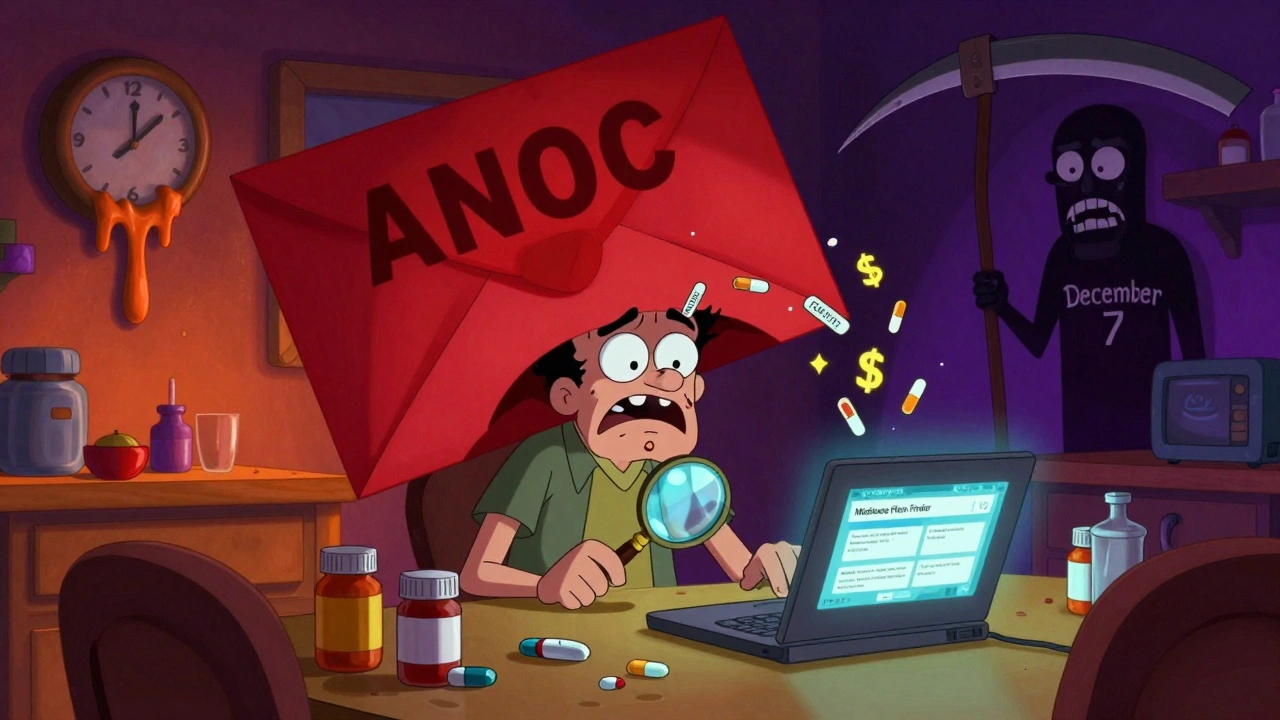

Medicare Open Enrollment: What You Need to Know About Coverage Changes and Deadlines

When you're on Medicare, a U.S. federal health insurance program for people 65 and older, and some younger people with disabilities. Also known as Original Medicare, it covers hospital stays and doctor visits—but it doesn't include prescription drugs or extra benefits unless you add them. That’s where Medicare open enrollment, the annual period when you can change your Medicare plan without medical underwriting. Also known as Annual Enrollment Period, it’s your only guaranteed chance each year to switch from Original Medicare to a Medicare Advantage plan, or vice versa, without risking coverage gaps. This isn’t just paperwork—it’s a real opportunity to lower your monthly bills, get better drug coverage, or add dental and vision benefits you didn’t have before.

Many people don’t realize that Part D prescription drug plans, standalone plans that cover medications not included in Original Medicare. Also known as Medicare drug coverage, they vary wildly in cost and coverage. What worked last year might cost more this year, or your favorite meds might not be covered anymore. If you’re on a Medicare Advantage, an all-in-one alternative to Original Medicare offered by private insurers that often includes extra benefits. Also known as Medicare Part C, it bundles hospital, doctor, and often drug coverage into one plan, your plan’s network, copays, or pharmacy options could change. You might be paying more for the same care, or your doctor might no longer be in-network. That’s why reviewing your options every year isn’t optional—it’s essential.

Missing the window means you’re locked in until next year, and if you delay signing up for Part D when you’re first eligible, you could pay a lifelong penalty. The window is short: October 15 to December 7. Changes you make during this time take effect January 1. No need to wait for a life event like moving or losing coverage—this is your annual reset button. You don’t need to be sick or have a problem to act. Even if your current plan seems fine, prices and benefits shift. A $10 monthly savings on your premium could add up to $120 a year. A better drug plan could save you hundreds on prescriptions.

What you’ll find below are real, practical guides that break down how Medicare open enrollment actually works. You’ll see how people saved money switching from Original Medicare to Medicare Advantage, how to compare drug plans without getting lost in fine print, and why some folks paid penalties they didn’t need to. These aren’t theory pieces—they’re based on what’s happened in 2024 and what’s changing in 2025. Whether you’re new to Medicare or you’ve been on it for years, this collection gives you the tools to make smarter choices—without the jargon, without the pressure, and without the guesswork.

How to Plan Annual Open Enrollment for Medication Coverage in Medicare

Learn how to review and switch Medicare drug plans during Open Enrollment to save hundreds on prescriptions. Avoid costly formulary changes and pharmacy network pitfalls with this step-by-step guide.